By Liya Davidov

Features Editor

College students often face the inner debate of what to spend their money on and when it is appropriate to dip into their savings account when their debit card is running low. With Campus Town restaurants a short walk away and apps like DoorDash and GrubHub ready to deliver at 3:30 a.m. when the cravings hit, it’s important to think about our purchasing decisions and work on creating better spending habits.

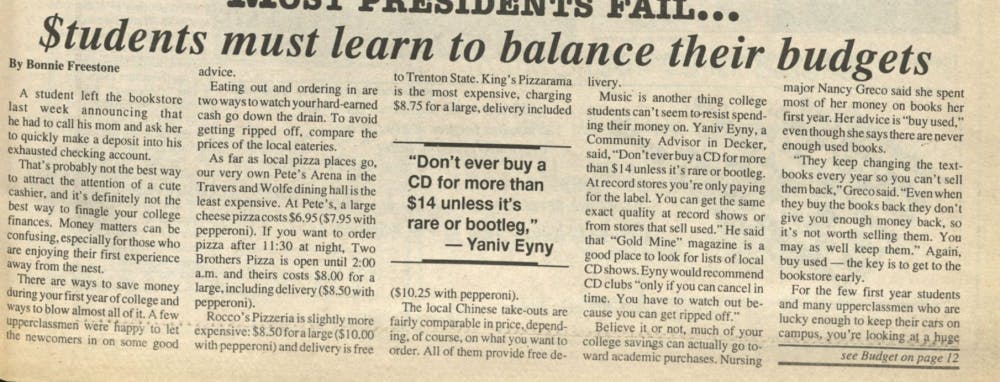

In a September 1995 issue of The Signal, a reporter recognized the need for students to learn how to balance their budgets, offering price-checks on popular purchases.

There are ways to save money during your first year of college and ways to blow almost all of it. A few upperclassmen were happy to let the newcomers in on some good advice.

Eating out and ordering in are two ways to watch your hard-earned cash go down the drain. To avoid getting ripped off, compare the prices of the local eateries.

As far as local pizza places go, our very own Pete’s Arena in the Travers and Wolfe dining hall is the least expensive. At Pete’s, a large cheese pizza costs $6.95 ($7.95 with pepperoni). If you want to order pizza after 11:30 at night, Two Brothers Pizza is open until 2:00 a.m. and theirs costs $8.00 for a large, including delivery ($8.50 with pepperoni).

Rocco’s Pizzeria is slightly more expensive: $8.50 for a large ($10,00 with pepperoni) and delivery is free to Trenton State. King’s Pizzarama is the most expensive, charging $8.75 for a large, delivery included ($10.25 with pepperoni).

The local Chinese take-outs are fairly comparable in price, depending, of course, on what you want to order. All of them provide free delivery.

Music is another thing college students can’t seem to resist spending their money on. Yaniv Eyny, a Community Advisor in Decker, said, “Don’t ever buy a CD for more than $14 unless it’s rare or bootleg. At record stores you’re only paying for the label. You can get the same exact quality at record shows or from stores that sell used.” He said that “Gold Mine” magazine is a good place to look for lists of local CD shows. Eyny would recommend CD clubs “only if you can cancel in time. You have to watch out because you can get ripped off.”

Believe it or not, much of your college savings can actually go toward academic purchases. Nursing major Nancy Greco said she spent most of her money on books her first year. Her advice is “buy used,” even though she says there are never enough used books.

“They keep changing the textbooks every year so you can’t sell them back,” Greco said. “Even when they buy the books back they don’t give you enough money back, so it’s not worth selling them. You may as well keep them.” Again, buy used -- the key is to get to the bookstore early.

For the few first year students and many upperclassmen who are lucky enough to keep their cars on campus, you’re looking at a huge financial undertaking, as you may have already discovered. Denise Graf, a community advisor for the First Year Experience Program, says she will pay $110 a month in car payments, $150 a month on insurance, $54 per semester for parking and additional money on gas to keep her car on campus this year.

Is it worth it? “Oh yeah!” Graf said.

How should you pay for all of these hideous expenses? Veronica Wolf and Cynthia Banta agree that getting a credit card is a good idea.

Banta advises students to stay away from American Express “because it’s not accepted in a lot of places.

“Most cards geared toward students don’t have an annual fee but have a high finance charge for late payments and high interest rates,” Banta said.

“Department stores often give you 10 percent off of purchases. But stay away from things with annual fees,” Wolf said.

Most students will agree that credit cards, while convenient, can be dangerous to the savings account.

“It took me half the summer to pay off my credit card debt,” Wolf said.

Calling cards are useful in saving money on those first year phone bills, and some even include extra perks such as cheap airline tickets offered by AT&T and an hour of free phone time from Sprint.

When asked what advice he’d give a first year student on how to keep the phone bills down, a business major said, “Just break up with the person!”

And finally, what about cash? What happens to the money you take out of the MAC machine that seems to disappear within seven days? Law and justice major Sean Philips said, “Last year I had a super-huge spending spree toward the beginning of the year and then I ran out of fundage by the end of the year. This year I’m going to try to even out my spending.”