By Michelle Lampariello

Editor-in-Chief

The College’s participation in the Student Health Insurance Plan provided by Aetna Student Health for the 2018-2019 academic year has changed the way students will receive coverage if they choose to purchase health insurance from the College.

All students at the College are required to have health insurance, whether they purchase it from the school or remain covered under a parent or guardian’s plan. Last year, students who purchased health insurance from the College were covered under UnitedHealthcare. Despite the switch from United to Aetna this academic year, coverage remains the same for all full-time students, with one key difference — their insurance is now accepted at InFocus Urgent Care in Campus Town.

InFocus does not accept United health insurance, which put a financial burden on students who purchased their insurance from the College and then received treatment at the urgent care for injuries and illnesses including cold and flu viruses, STDs, broken bones, trauma and intoxication-related medical issues. InFocus also provides specialty treatments including travel vaccines, sports physicals and medication-assisted opioid dependency treatment.

The health insurance students purchased from the College for this academic year now covers any of these treatments, a luxury not afforded to students who purchased insurance from the College last academic year.

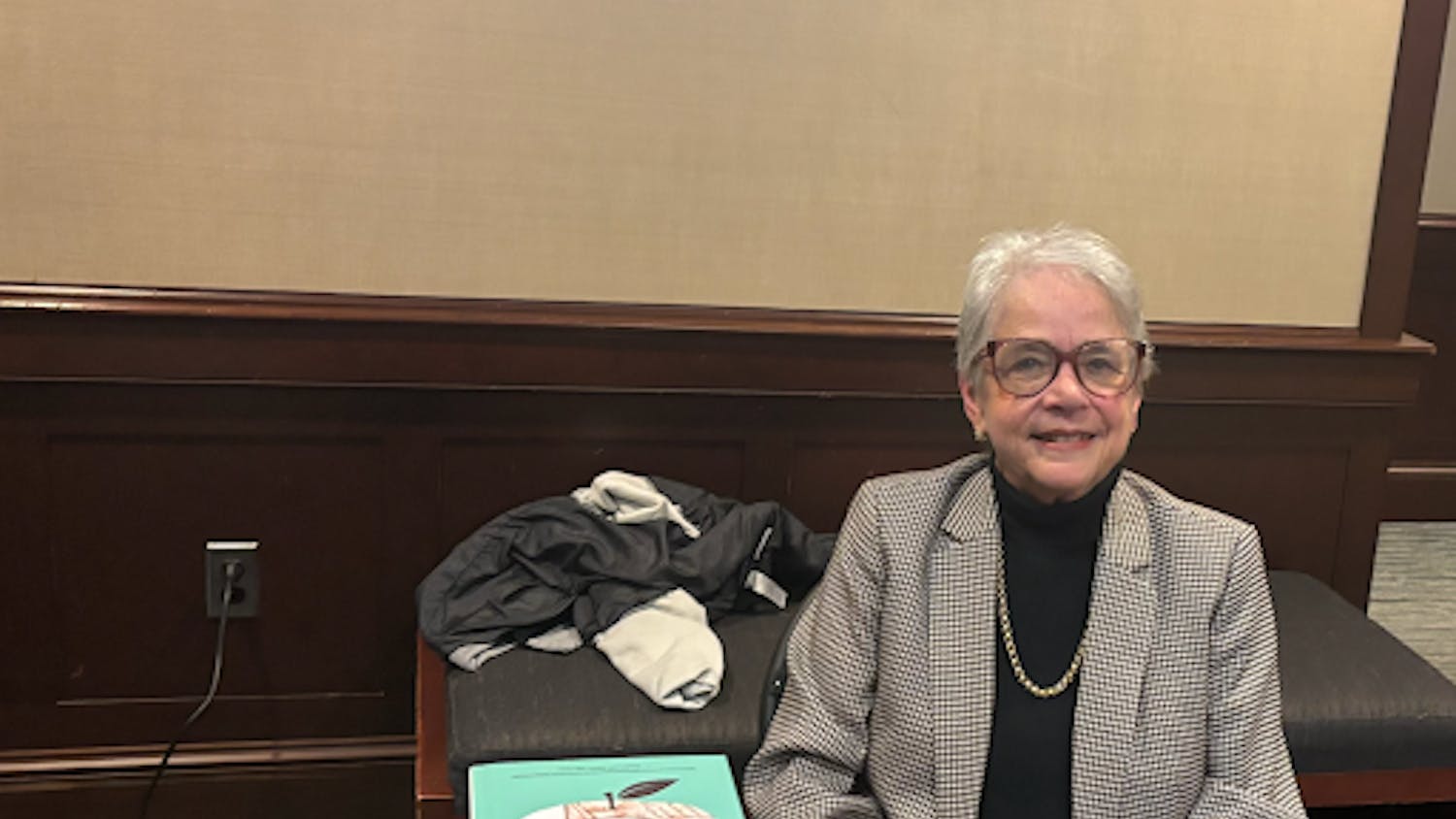

“They should be able to use their health insurance to receive any services at the urgent care,” said Dr. Seeta Arjun, head doctor and owner of InFocus.

For part-time students, who are not eligible to purchase health insurance through the College from neither United nor Aetna, as well as full-time students who are using their parents’ insurance, their experience at InFocus remains unchanged. However, those who receive coverage through the College’s new Aetna plan will now no longer have to face the hefty copay that once burdened students who purchased United insurance from the College, making the urgent care in Campus Town a more viable option for students seeking medical attention.

“Previously we were not in network with United, but now that they switched over to Aetna it will make it much easier to take care of the student population,” said Scott Perrine, InFocus’ Director of Corporate Development.

Students who purchase insurance from the College will still be responsible for a copay if they receive care at InFocus, but the cost has become much more manageable now that the College is participating with a plan that is also accepted by the urgent care, as students will no longer have to pay the full fee for their visit.

Perrine and Arjun estimate that within the next 30-60 days, they will be able to determine if the College’s switch from United to Aetna has made an impact on the number of students who choose to receive treatment at InFocus.